Flsa Exempt Threshold 2024

Flsa Exempt Threshold 2024. Section 13(a)(1) and section 13(a)(17) also exempt certain computer employees. On april 23, 2024, the u.s.

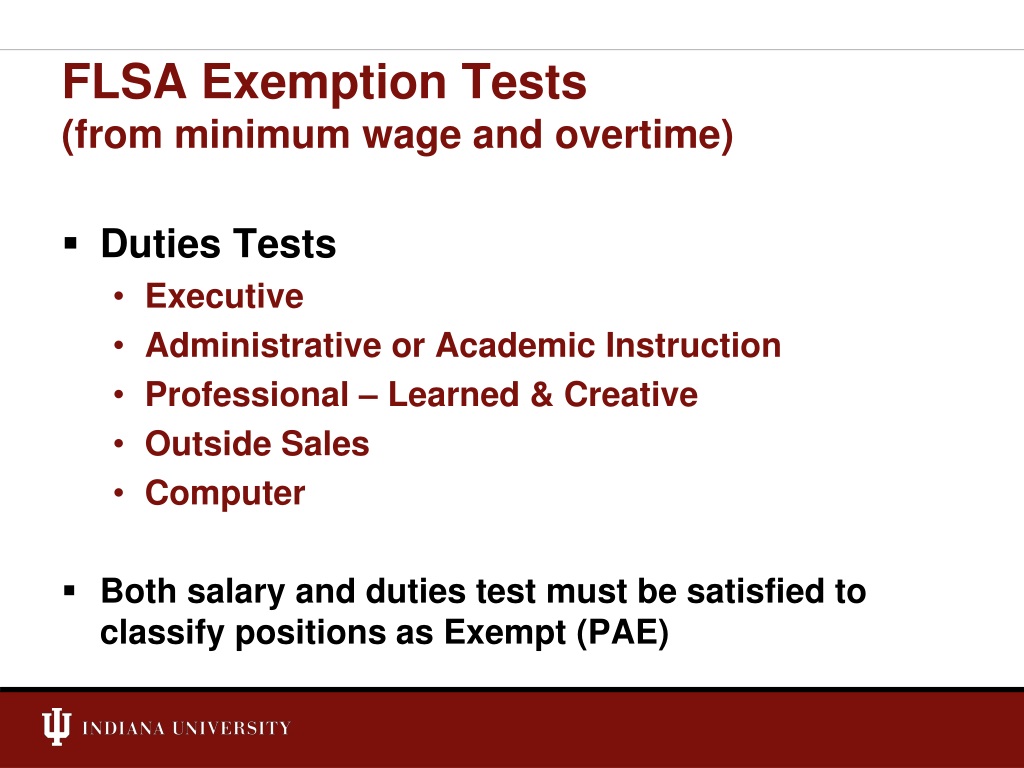

However, section 13(a)(1) of the flsa provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees. Effective july 1, 2024, the salary threshold will increase to the equivalent of an annual salary of $43,888 and increase to $58,656 on jan.

On January 1, 2025, That Eligibility Expands To Most Salaried Workers Earning Less Than $1,128 Per Week.

On july 1, 2024, the department of labor’s rule raising the salary threshold for workers to be exempt from the overtime requirements of the fair labor standards act becomes effective.

(1) The Employee’s Job Duties Must Qualify.

The united states department of labor (“dol”) released a final rule on april 23, 2024, significantly raising the minimum salary threshold for various exemptions under the fair labor standards act (“flsa”).

Department Of Labor (Dol) Unveiled A New Final Rule That Will Significantly Raise The Minimum Salary Threshold To Qualify For Certain Overtime Exemptions Under The Fair Labor Standards Act (Flsa), Changing Which Employees Will Be Entitled To Overtime Pay And Affecting Employer Compensation Structures.

Images References :

Source: hettyqvallie.pages.dev

Source: hettyqvallie.pages.dev

Dol Flsa Salary Threshold 2024 Colly Rozina, This fact sheet provides information on the salary basis requirement for the exemption from minimum wage and overtime pay provided by section 13 (a) (1) of the flsa as defined by regulations, 29 c.f.r. On april 23, the department of labor (dol) issued its final rule to alter the overtime pay regulations under the flsa.

Source: janelbmilzie.pages.dev

Source: janelbmilzie.pages.dev

New York Flsa Salary Threshold 2024 Susy Zondra, Flsa rule changes become effective july 1, 2024. Department of labor announced a final rule, defining and delimiting the exemptions for executive, administrative, professional, outside sales, and computer employees, effective as of july 1, 2024.

Source: oliaqjuanita.pages.dev

Source: oliaqjuanita.pages.dev

Flsa Exemption Salary Threshold 2024 Rona Vonnie, This fact sheet provides information on the salary basis requirement for the exemption from minimum wage and overtime pay provided by section 13 (a) (1) of the flsa as defined by regulations, 29 c.f.r. However, section 13(a)(1) of the flsa provides an exemption from both minimum wage and overtime pay for employees employed as bona fide executive, administrative, professional and outside sales employees.

Source: hyndaqkylynn.pages.dev

Source: hyndaqkylynn.pages.dev

California Flsa Salary Threshold 2024 Chart Leann Myrilla, (1) the employee’s job duties must qualify. This fact sheet provides information on the salary basis requirement for the exemption from minimum wage and overtime pay provided by section 13 (a) (1) of the flsa as defined by regulations, 29 c.f.r.

Flsa Exempt Salary Threshold 2024 Schedule Printable Aubrey Goldina, On july 1, 2024, the department of labor’s rule raising the salary threshold for workers to be exempt from the overtime requirements of the fair labor standards act becomes effective. At issue is the department’s april 23 final rule, which increased the salary threshold for employees to qualify as exempt from overtime under the fair labor standards act (flsa).

Source: janelbmilzie.pages.dev

Source: janelbmilzie.pages.dev

New York Flsa Salary Threshold 2024 Susy Zondra, On tuesday, april 23, 2024, the u.s. On april 24, 2024, the us department of labor (dol) announced the highly anticipated revisions to the salary thresholds for the fair labor standards act’s (flsa’s) “white collar” overtime exemptions.

Source: crinbfelicle.pages.dev

Source: crinbfelicle.pages.dev

Flsa Duties Test 2024 Glory Kamilah, On april 23, 2024, the u.s. Department of labor announced a final rule, defining and delimiting the exemptions for executive, administrative, professional, outside sales, and computer employees, effective as of july 1, 2024.

Flsa Exemption Salary Threshold 2024 Rona Vonnie, Section 13 (a) (1) and section 13 (a) (17) also exempts certain computer employees. Some workers are specifically exempt from the flsa’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees.

Flsa Minimum Salary Threshold 2024 Bambi Neille, The rule revises the regulations issued under the fair labor standards act (flsa) that implement the exemptions from minimum wage and overtime pay requirements. At issue is the department’s april 23 final rule, which increased the salary threshold for employees to qualify as exempt from overtime under the fair labor standards act (flsa).

Source: www.wageandhourdevelopment.com

Source: www.wageandhourdevelopment.com

Biden Administration Announces April 2024 Release of Final Rule on FLSA, Today, an employee must earn at least $684 per week (about $35,568 per year) to be exempt. The united states department of labor (“dol”) released a final rule on april 23, 2024, significantly raising the minimum salary threshold for various exemptions under the fair labor standards act (“flsa”).

However, Section 13(A)(1) Of The Flsa Provides An Exemption From Both Minimum Wage And Overtime Pay For Employees Employed As Bona Fide Executive, Administrative, Professional And Outside Sales Employees.

The united states department of labor (“dol”) released a final rule on april 23, 2024, significantly raising the minimum salary threshold for various exemptions under the fair labor standards act (“flsa”).

However, Section 13 (A) (1) Of The Flsa Provides An Exemption From Both Minimum Wage And Overtime Pay For Employees Employed As Bona Fide Executive, Administrative, Professional And Outside Sales Employees.

The fair labor standards act (flsa) requires that executive, administrative and professional positions meet a salary threshold (in addition to duties tests), to be considered exempt from the minimum wage and overtime requirements of the flsa.